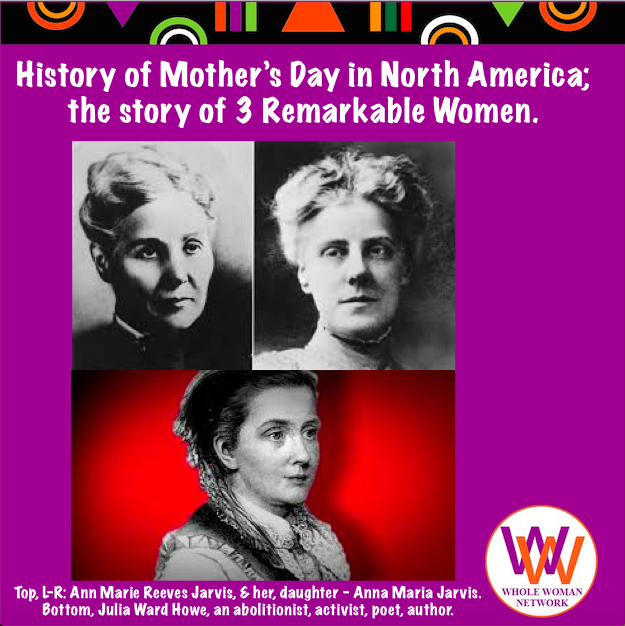

Here’s wishing you a Happy Mother’s Day! (P.S: Everyday should be Mother’s day). Beyond the commercialization of Mother’s Day in North America, here’s a peek into the history & intentions of its remarkable founder(s): Ann Marie Reeves Jarvis, Anna Marie Jarvis and Julia Ward Howe. #CelebratingWomenWhoDare

History is fascinating, and the history of women who shaped history in their own way, even more so. History has a way of giving a nuanced context to seemingly isolated (contemporary) issues.

This post was inspired by an interesting and insightful conversation, a long while ago, on the Facebook wall of Marianne Williamson (www.facebook.com/williamsonmarianne), based on a post she made on her wall titled: “The original Mother’s Day idea was for women to gather from all over the world to take a stand against war.”

[Other sources for the post below are http://www.plough.com and wikipedia].

The History of Mother’s Day Celebration in America:

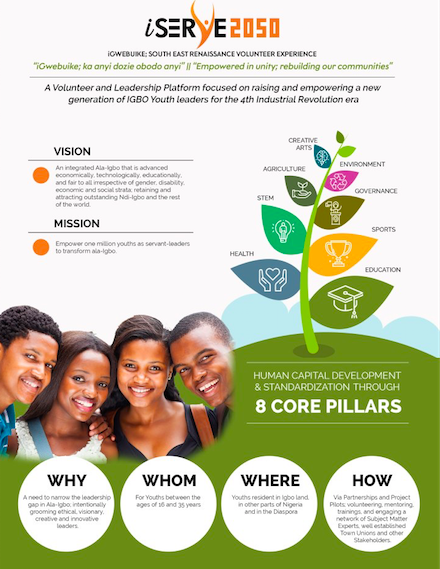

In summary, social activist, Ann Marie Reeves Jarvis founded the American celebration of its version of Mother’s Day in 1858. It initially started as a call for health sanitation.

A few years later in 1870, Poet and Activist, Julia Ward Howe, who was herself inspired by Ann Jarvis, wrote the Mother’s Day Proclamation as a call to Peace.

After the death of Ann Marie Reeves Jarvis, her daughter Anna Marie Jarvis embarked on a mission to make Mother’s Day an officially recognized holiday in the United States.

The Fascinating Back-story of 3 Phenomenal Women!

Image below: Ann Marie Reeves Jarvis and her daughter, Anna Marie Jarvis

- Ann Marie Reeves Jarvis

The history of Mother’s Day in America begins with a remarkable woman named Ann Marie Reeves Jarvis. She bore between eleven and thirteen children over the course of seventeen years. Of these children, only four survived to adulthood.

The others died of diseases such as the measles, typhoid fever, and diphtheria epidemics common in Appalachian communities in Taylor County. These losses inspired Jarvis to take action to help her community combat childhood diseases and unsanitary conditions.

Mrs. Jarvis was a dynamic woman who saw needs in her community and found ways to meet them. In 1858, while pregnant with her sixth child, Jarvis began Mothers’ Day Work Clubs in 5 surrounding towns to improve health and sanitary conditions. She and other area women joined a growing public health movement in the United States.

Jarvis’ clubs sought to provide assistance and education to families in order to reduce disease and infant mortality. These clubs raised money to buy medicine and to hire women to work in families where the mother suffered from tuberculosis or other health problems. They developed programs to inspect milk long before there were state requirements.

Club members visited households to educate mothers and their families about improving sanitation and overall health. The clubs benefited from the advice of Jarvis’ brother, Dr. James Reeves, who was known for his work in the typhoid fever epidemics in northwestern Virginia.

During the American Civil War (1861-1865), sentiment in western Virginia was sharply divided between north and south. In 1863, this culminated when the western part of the state broke away from Virginia and formed the new state of West Virginia, which was loyal to the Union. Western Virginia became the location of some of the first conflicts of the Civil War. Jarvis’ Mothers’ Day Work Clubs altered their mission to meet the changing demands brought about by war.

Ann Jarvis urged the clubs to declare neutrality and to provide aid to both Confederate and Union soldiers. Jarvis illustrated her resolve to remain neutral and aid both sides by refusing to support a proposed division of the Methodist Church into a northern and southern branch.

Additionally, she reportedly offered a lone prayer for Thornsbury Bailey Brown the first Union soldier killed by a Confederate in the area, when others refused. Under her guidance, the clubs fed and clothed soldiers from both sides who were stationed in the area.

When typhoid fever and measles broke out in the military camps, Jarvis and her club members nursed the suffering soldiers from both sides at the request of a commander.

Jarvis’ efforts to keep the community together continued after the Civil War ended. After the fighting concluded, public officials seeking ways to eliminate post-war strife called on Jarvis to help.

She and her club members planned a “Mothers Friendship Day” for soldiers from both sides and their families at the Taylor County Courthouse in Prunty town to help the healing process. Despite threats of violence, Jarvis successfully staged the event in 1868.

She shared with the veterans a message of unity and reconciliation. Bands played “Dixie” and the “Star Spangled Banner” and the event ended with everyone, north and south, joining together to sing “Auld Lang Syne.” This effective and emotional event reduced many to tears. It showed the community that old animosities were destructive and must end.

2. Julia Ward Howe

Julia Ward Howe – an abolitionist, Activist, poet and author, best remembered as the poet who wrote “Battle Hymn of the Republic” – worked to establish a Mother’s Peace Day.

Howe dedicated the celebration to the eradication of war, and organized festivities in Boston for years. A proclamation she wrote in 1870, which explains, in her own words, the goals of the original holiday.

Arise, all women who have hearts, whether your baptism be that of water or of tears! Say firmly: “We will not have great questions decided by irrelevant agencies, our husbands shall not come to us, reeking with carnage, for caresses and applause.

Our sons shall not be taken from us to unlearn all that we have been able to teach them of charity, mercy and patience. We women of one country will be too tender of those of another country to allow our sons to be trained to injure theirs.”

From the bosom of the devastated earth a voice goes up with our own. It says, “Disarm, disarm! The sword is not the balance of justice. Blood does not wipe out dishonour nor violence indicate possession.

As men have often forsaken the plow and the anvil at the summons of war, let women now leave all that may be left of home for a great and earnest day of counsel. Let them meet first, as women, to bewail and commemorate the dead. Let them then solemnly take counsel with each other as to the means whereby the great human family can live in peace, each learning after his own time, the sacred impress, not of Caesar, but of God.

In the name of womanhood and of humanity, I earnestly ask that a general congress of women without limit of nationality may be appointed and held at some place deemed most convenient and at the earliest period consistent with its objects, to promote the alliance of the different nationalities, the amicable settlement of international questions, the great and general interests of peace.”

3. Anna Marie Jarvis (The Daughter of Ann Marie Jeeves Jarvis)

On the first anniversary of Ann Marie Jeeves Jarvis’ death, her daughter, Anna Jarvis met with friends and announced plans for a memorial service remembering her mother for the next year. In May 1907, a private service was held in honour of Ann Jarvis. The following year, in 1908, Anna Jarvis organized the first official observance of Mother’s Day, coming near the anniversary of her mother’s death.

Andrews Methodist Church, where Ann Reeves Jarvis taught Sunday School for 25 years, held the first public service on the morning of May 10, 1908. Anna Jarvis did not attend the service, but sent a donation of 500 white carnations for all of those in attendance. In the afternoon, 15,000 people attended another service that Anna Jarvis organized in Philadelphia, held at the Wanamaker Store Auditorium.

In the years following the initial ceremonies, Anna Jarvis’ new holiday gained recognition in many states and spread to a number of foreign countries. Anna Jarvis also embarked on a mission to make Mother’s Day an officially recognized holiday in the United States.

She succeeded when, in 1914, President Woodrow Wilson signed a congressional resolution officially making the second Sunday in May the national Mother’s Day and calling for Americans to recognize it by displaying the flag by proclaiming it a national holiday and in his own words : “a public expression of our love and reverence for all mothers.”

—————-